swap in forex means

Swaps in Forex play an important yet confusing role. What is Swap in Forex.

Currency Swap Contract Definition How It Works Types

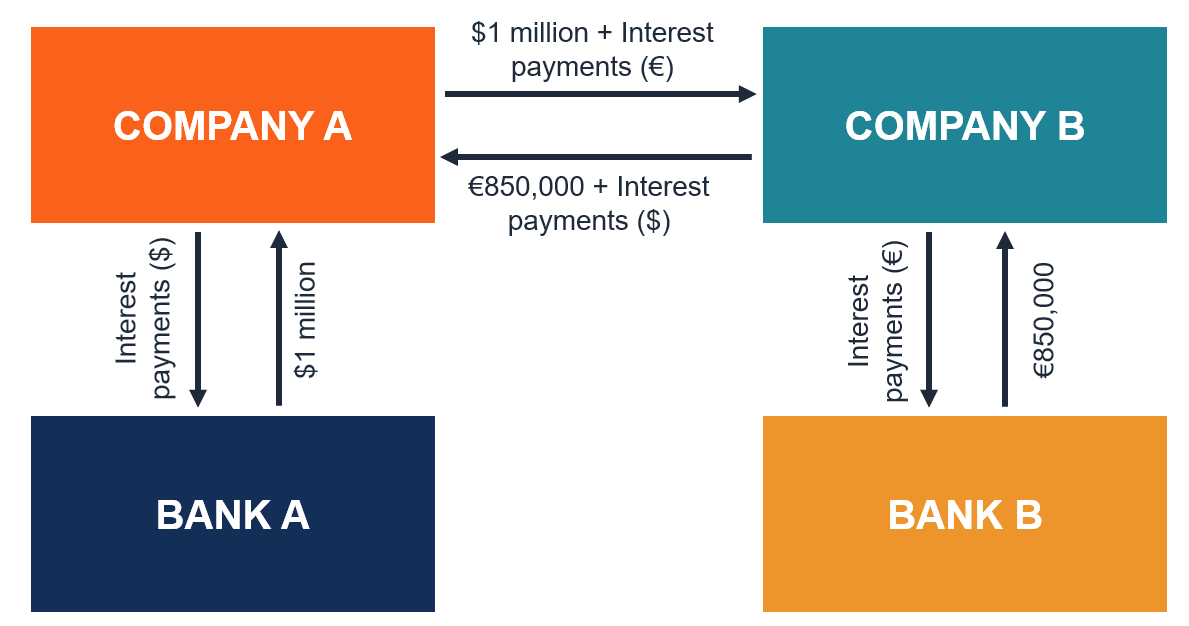

A swap is a derivative contract through which two parties exchange the cash flows or liabilities from two different financial instruments.

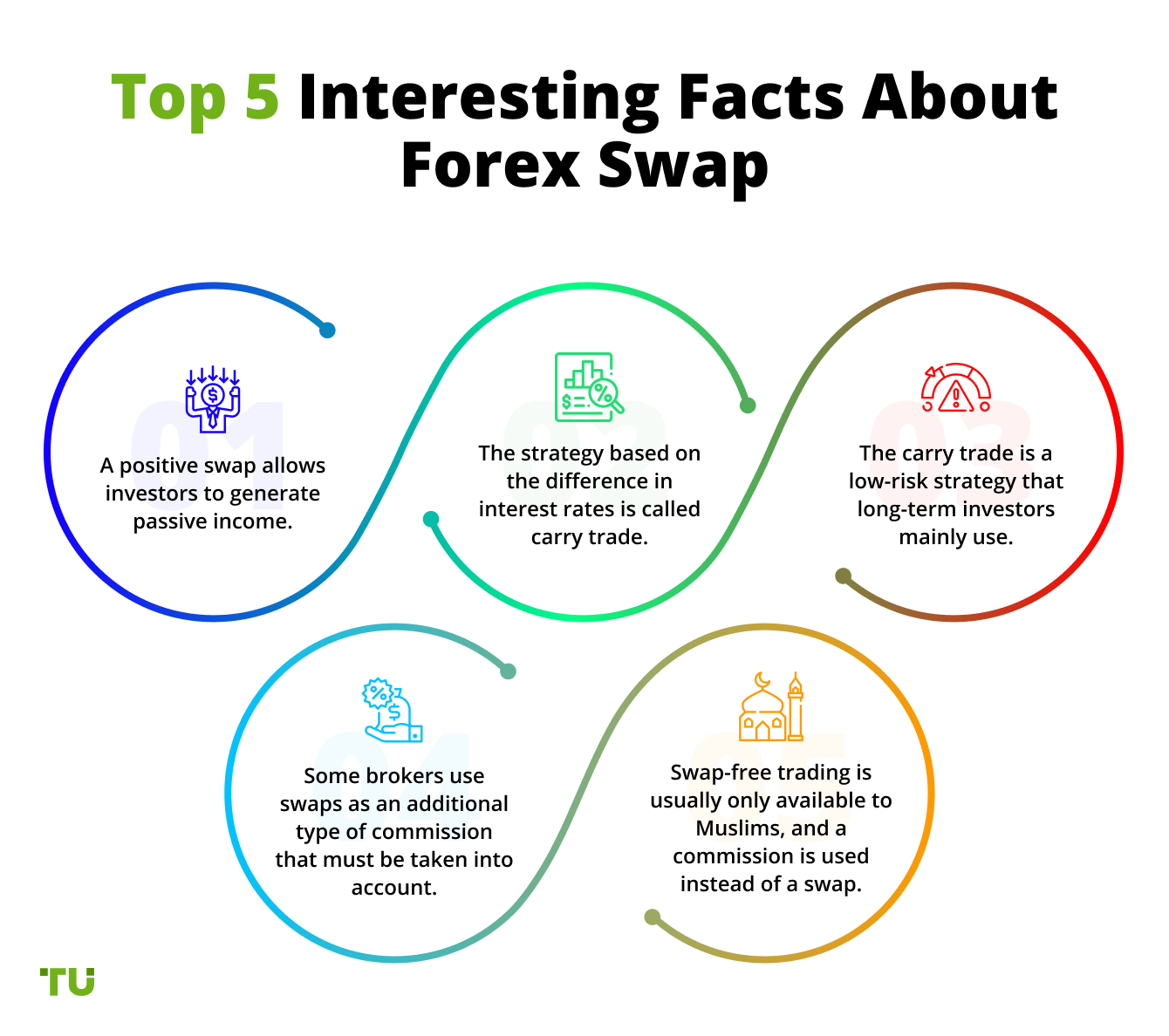

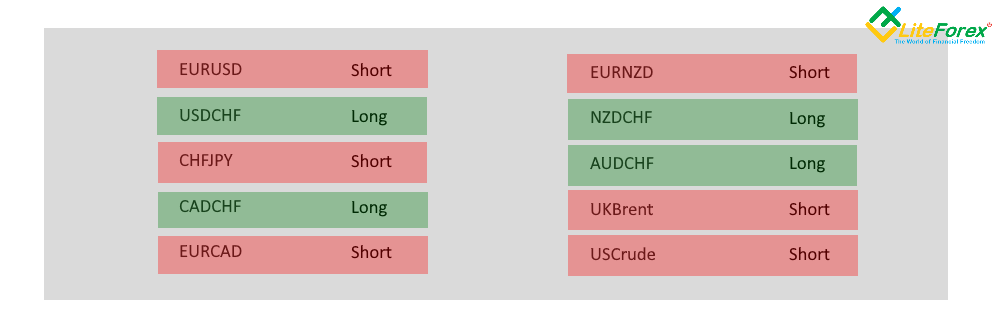

. Long swaps these are used when. There are two types of swaps. Islamic or swap-free accounts have recently been offered to the forex market as a new alternative to traditional accounts.

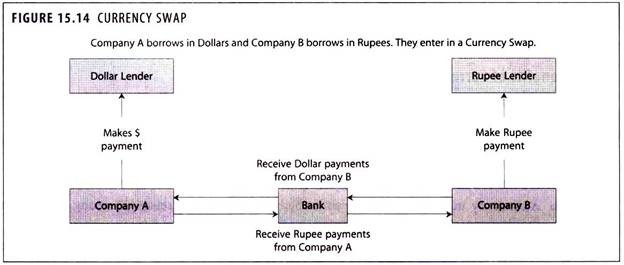

A currency swap involves the exchange of interestand sometimes of principalin one currency for the same in another currency. A swap in forex refers to the interest that you either earn or pay for a trade that you keep open overnight. Instead a swap in Forex is an interest fee which needs to either be paid in or will be charged added to.

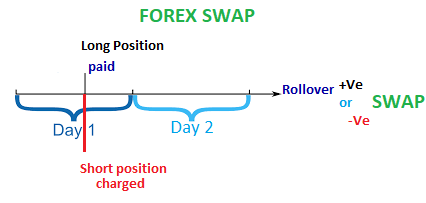

What is the meaning of swap in forex trading. A Swap in Forex is an interest payment that you either settle or collect for carrying positions overnight into the following day. Swap is the amount of money you receive or pay for holding a position overnight.

So a swap in forex trading is the interest that you pay or receive for keeping an open trade overnight. Basically a swap is the interest rate differential. Forex swap is not actually a physical swap.

Swap long used for keeping long positions open. It involves the payment of principal and swapping interest on currency exchange. Forex swap is an amount you gain or lose from overnight trades.

Swap long used for keeping long positions open. Most swaps involve cash flows. A foreign exchange swap also known as an FX swap is an agreement to simultaneously borrow one currency and lend another at an initial date then exchanging the.

A foreign currency swap is an agreement between two foreign parties to swap interest payments on a loan made in one currency for interest payments on a loan made in. In simple words swap is a special operation that carries an open position in a trading instrument overnight for which the difference in interest. These positions can bring profit or unnecessary losses Learn to calculate the costs.

A swap in forex refers to the interest that you either earn or pay for a trade that you keep open overnight. A swap which is also known as the rollover fee is the cost you need to pay if you keep a position open overnight. Dealers dont have to pay a fee or commission to use.

Companies doing business abroad. A currency swap is the simultaneous sale and purchase of the same amount of a given currency at a forward exchange rate. What is Swap.

What is a swap in Forex. These swaps come in two forms. In finance a foreign exchange swap forex swap or FX swap is a simultaneous purchase and sale of identical amounts of one currency for another with two different value dates and may use.

It is formed based on central banks interest rates of those countries whose. Search the Academy Look up the meaning of hundreds of trading. There are two types of swaps.

Here traders define a swap as the exchange of currencies between two forex trading companies.

Forex Swap Margin Treatment Uncertain Ahead Of Vm Deadline Risk Net

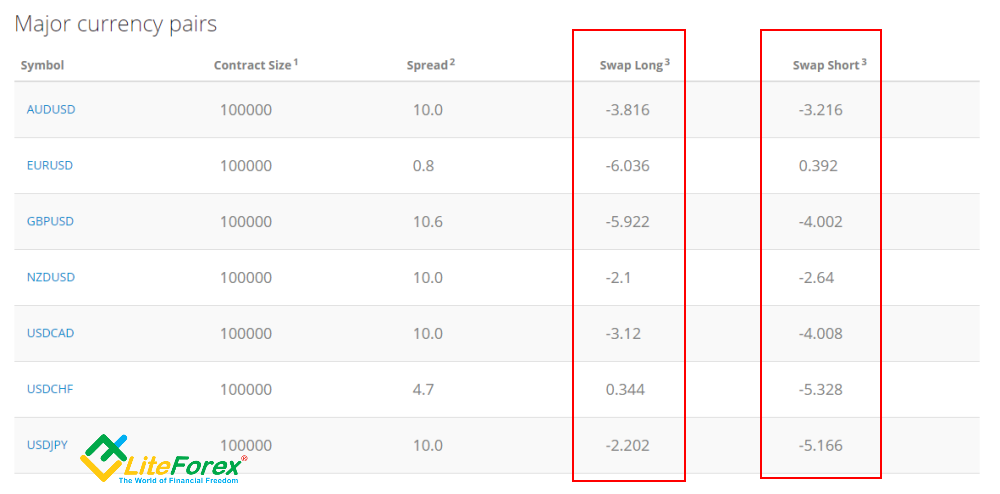

What Is Swap In Forex Trading How To Calculate Fx Swaps Examples Litefinance Ex Litefinance

Foreign Exchange Market Meaning Participants Types Graph

Swap And Rollover In Forex Trading Explained Equiti Blog

:max_bytes(150000):strip_icc()/Forex_Version2_4196203-a36613fb2bac4e14a613cc20fe95cc4a.png)

Forex Fx How Trading In The Foreign Exchange Market Works

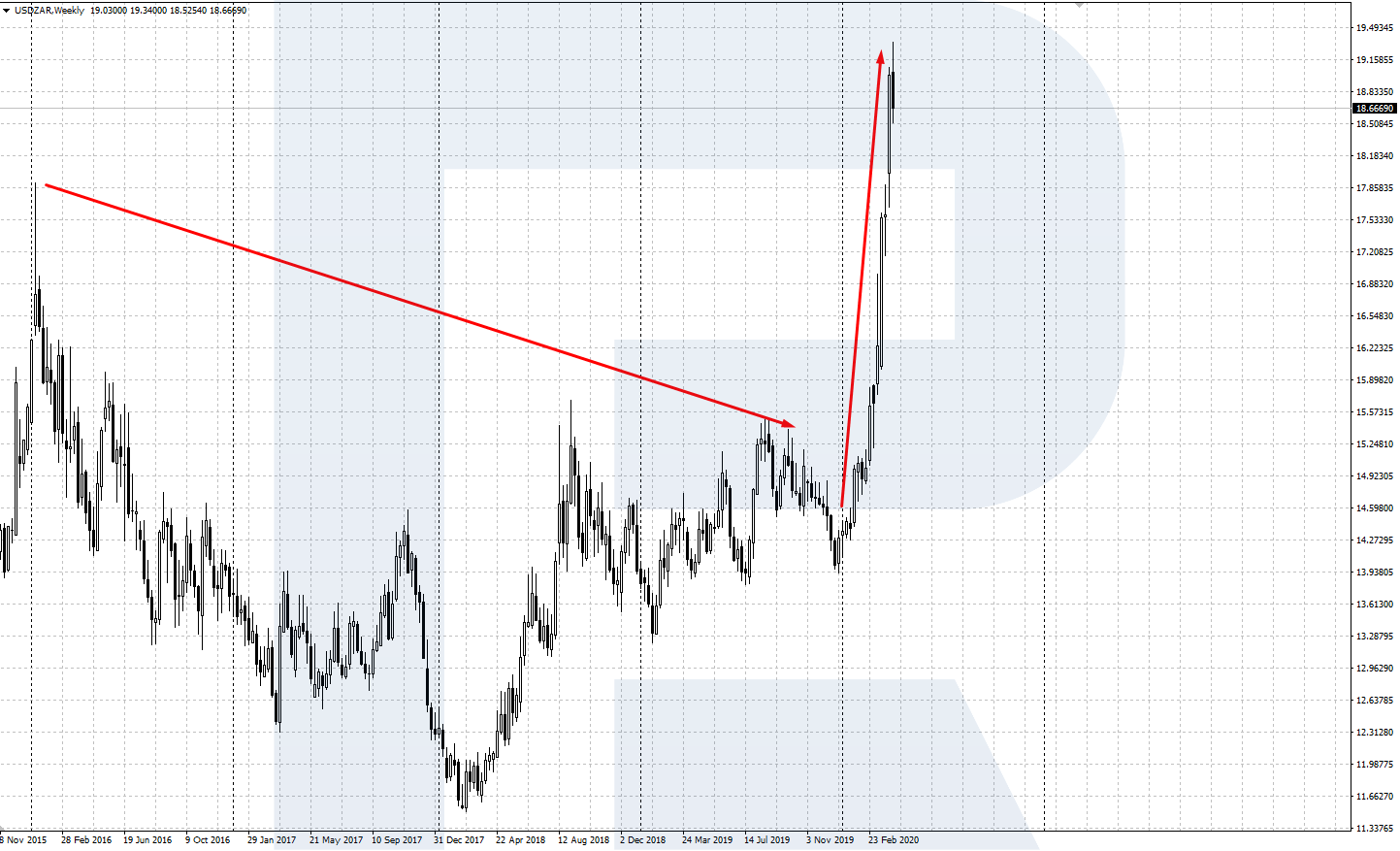

Explaining The Meaning Of A Swap On Forex Examples Of Use

What Is The Swap In Forex How Does It Affect Trading

Explaining The Meaning Of A Swap On Forex Examples Of Use

What Is The Foreign Exchange Market Definition Instruments Of Trading Thestreet

Forex Spot Exchange Forward Rate Forex Swap Front To Back Process

Secrets Behind Forex Swap Complete Guide Freeforexcoach Com

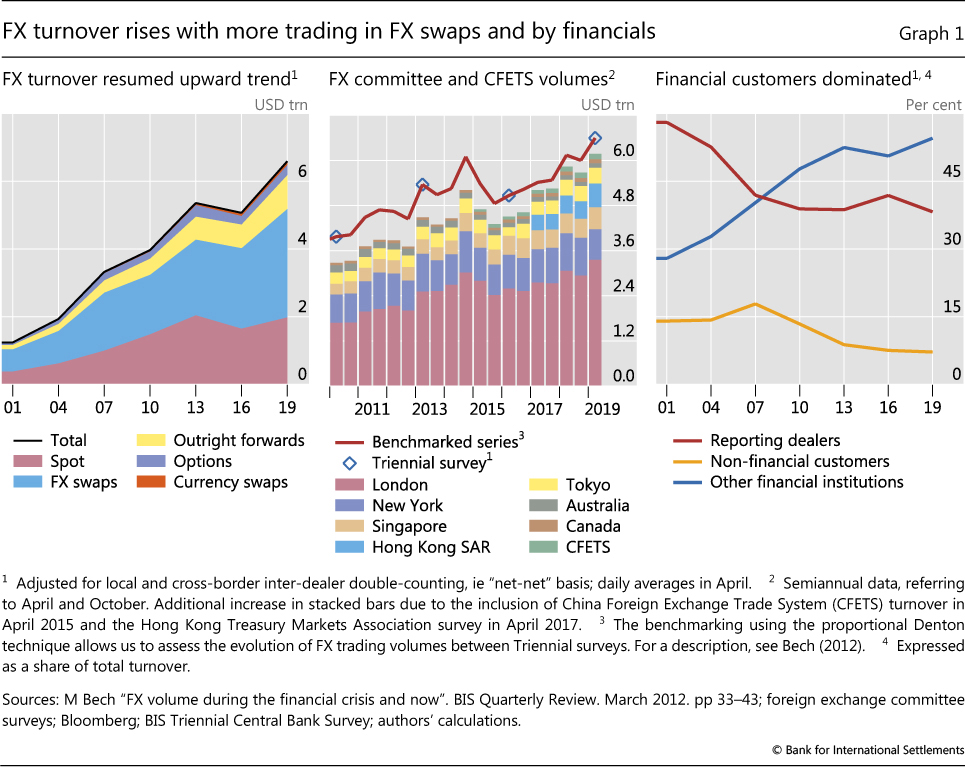

Sizing Up Global Foreign Exchange Markets

Currency Swap Meaning And Benefits Foreign Exchange Financial Management

Swap In Finance Complete Guide On Swaps In Finance

Swaps What They Are And How They Work Bbva

What Is Swap In Forex Trading How To Calculate Fx Swaps Examples Litefinance Ex Litefinance